Can fabless be the next SaaS for India?

The ongoing global semiconductor crisis has adversely impacted 170-plus manufacturing industries across the spectrum, from personal computers and smartphones to dishwashers and automobiles. As the Covid-19 pandemic pushed economies into multiple lockdowns, chip production facilities had to be shut down for the major part, consequently running global stocks dry.

The demand for chips, however, did not decline. Rather, the worldwide shift to remote work led to a surge in demand for smartphones, personal computers, smart home devices, gaming consoles, and myriad home appliances. Even demand for automobiles bounced back quickly as lockdowns gradually eased across countries.

The crisis, which is tipped to continue into next year, is expected to vastly alter the dynamics and scale of the global chip manufacturing industry.

In September, technology research firm IDC forecast that the semiconductor market would grow by 17.3% in 2021 compared to 10.8% last year when worldwide revenues stood at $464 billion. In fact, the firm noted in its report that there was a potential for overcapacity in 2023 as larger scale capacity expansions start to kick in late next year. “5G semiconductor revenues will increase by 128%, with total mobile phone semiconductors expected to grow by 28.5%. Game consoles, smart home, and wearables will grow +34%, 20%, 21% respectively. Automotive semiconductor revenues will also increase by 22.8% as shortages are mitigated by year end. Notebook semiconductor revenues will grow by 11.8%, while X86 Server semi revenues will increase by 24.6%,” it said in its report.

The global chip shortage and geopolitical developments involving the United States and China may present India with opportunities to accelerate growth.

Global Semiconductor Ecosystem

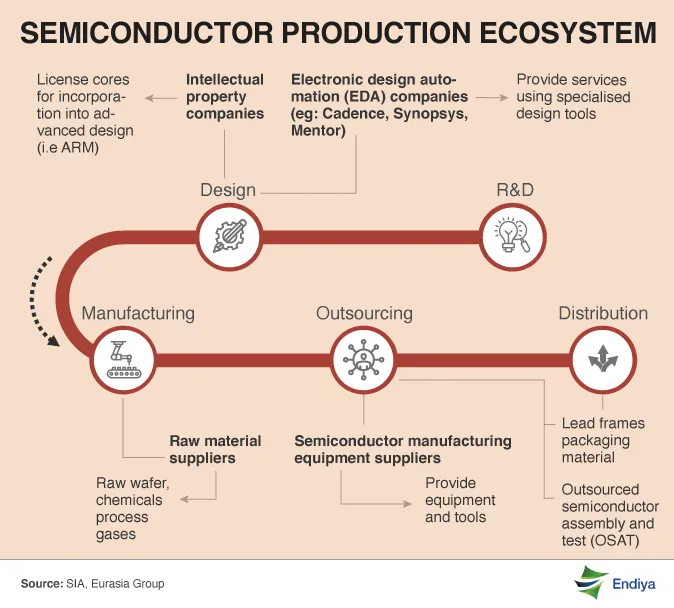

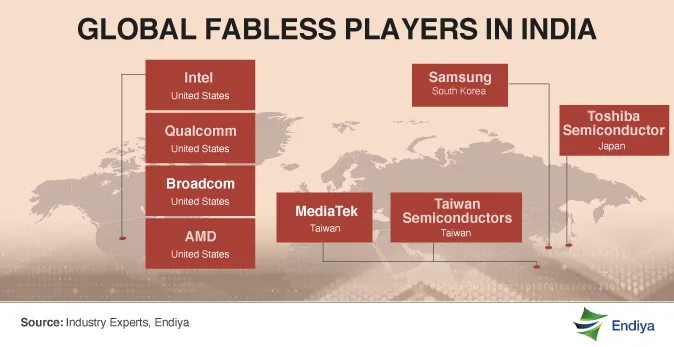

The most prevalent business model in semiconductor manufacturing is the foundry model which consists of a semiconductor fabrication plant and an integrated circuit design operation (eg: GlobalFoundries, TSMC, UMC). Then there are fabless companies, which design chips and outsource production (eg: AMD, Nvidia, Qualcomm). There are also IDMs (integrated device manufacturers) that design and manufacture integrated circuits (eg: Intel, Samsung, Texas Instruments).

While the foundry segment of the business is dominated by China, Taiwan and South Korea, the fabless side is almost entirely ruled by the United States.

The semiconductor ecosystem also consists of EDA (Electronic Design Automation) companies which assist in the design, planning, implementation, verification and manufacture of chips. Major players in this segment include Cadence Design and Synopsys, both based in the United States, and German multinational Siemens. There are also third-party providers of semiconductor assembly and testing (OSATs). Well known players include ASE, Amcor and JCET. It is well known that as per Moore’s Law, semiconductors would double in circuit density every two years. The leading companies in the space have, therefore, been in a race to create more dense and powerful ICs (Integrated Circuits). South Korea’s Samsung and Taiwan’s TSMC are at present the only two companies that manufacture chips at the most advanced process nodes (under 7 nm) at scale. The leading producers are currently looking to transition into the 5nm and 3nm processing nodes.

China - US Spat

While the pandemic triggered the ongoing chip crisis, the trade war between the United States and China further complicated matters. In a series of developments, the US restricted the supply of cutting-edge chips from TSMC to Huawei in order to block the Chinese company’s 5G rollouts. The moves by Washington have been effective in its bid to convince European allies to ban Chinese 5G supplies.

China has been trying to parry the American attack with a bunch of fixes. In one of its most significant attempts, it has pumped over $200 billion into its massive National IC Investment fund. Also, as a workaround for the Huawei-TSMC strictures, talks are ongoing with Taiwan’s smartphone chip supplier MediaTek and with UNISOC, a leading domestic chipmaker backed by Tsinghua Unigroup. Both rely on TSMC for their less than 10 nm fabrication.

The Huawei restriction situation has been causing global disruption in the telecom sector. The UK government, for example, is concerned about having to remove Huawei equipment from the networks of their mobile operators. The ban would reportedly delay the arrival of 5G in the UK by two years costing the operators at least £2 billion.

India’s fabless future

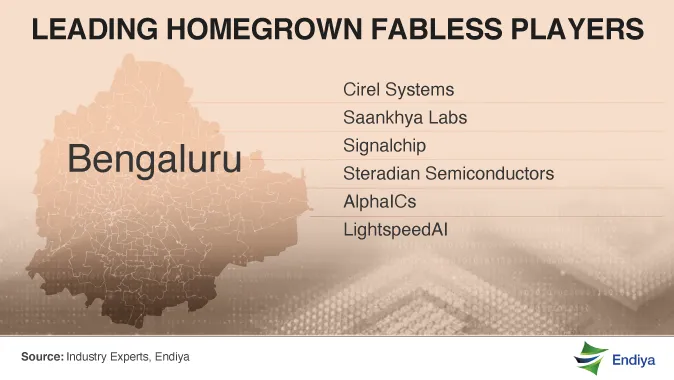

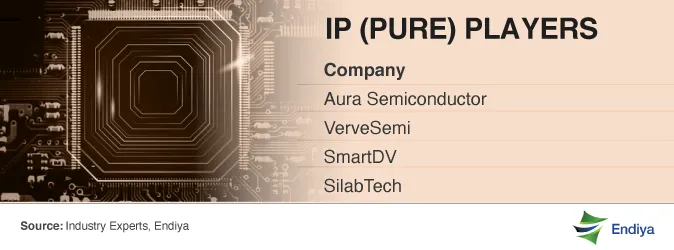

India, over the past two decades, has made considerable progress in the fabless segment. In terms of size it is still relatively nascent, with cumulative annual revenues estimated at a little over $50 million. In recent years, companies such as Steradian Semiconductors, AlphaICs, Cirel Systems, Saankhya Labs, LightspeedAI and Aura Semiconductors have been successful at designing and building competitive circuit enhancements.

In the past, India has struggled to adequately incentivize the creation of a fabless hub. The government, in 2017, invited foreign companies to set up facilities in India by waiving customs duties for relevant imports. The offer had no takers. Subsequently, it sent out an expression of interest (EOI) inviting companies interested in setting up fabs. The EOI’s deadline was April 2021. India also tried to woo semiconductor giant Intel to set up a facility in India, only to lose the bid to Vietnam.

For emerging companies and startups, the lack of availability of risk capital presents yet another challenge. While fail fast, fail cheap is possible in a space like SaaS, thanks to AWS, Azure and Google Cloud startup programmes, it costs $8 million to $10 million and a couple of years to produce a production quality chip. It would make a big difference if EDA vendors like Cadence, Synopsys and Siemens EDA, and fabs such as TSMC and GlobalFoundries partner and aggressively offer credits to fabless startups to ensure venture capital money flow to the sector.

India has deep design, verification, firmware talent -- the necessary ingredients for the success of a fabless startup. With the right government incentives and access to adequate capital at the critical moment, homegrown talent could be harnessed for the growth of the fabless industry.

(The article has also been published by Yourstory)